Asset Protection Lawyer

Practice Areas

- Family Law

- Annulment

- Asset Protection

- Celebrity Divorce

- Child Custody

- Child Support

- Complex Property Division

- Divorce

- Domestic Partnership Same Sex Divorce Lawyer

- Paternity

- Domestic Violence

- Grandparents Rights

- High Net Worth Divorce

- LGBTQ Divorce

- Mediation

- Military Divorce

- Prenuptial Agreement

- Restraining Orders

- Spousal Support

- Personal Injury

- Amputation

- Bicycle Accidents

- Brain Injuries

- Burn injuries

- Bus Accidents

- Car Accidents

- Catastrophic Injuries

- Dog Bite Injuries

- Lyft Rideshare Accidents

- Motorcycle Accident

- Nursing Home Abuse

- Pedestrian Accidents

- Premises Liability

- Slip & Fall Injuries

- Spine Injuries

- Truck Accidents

- Uber Rideshare Accident

- Wrongful Deaths

- Criminal Defense

- Civil Litigation

- Workers’ Compensation

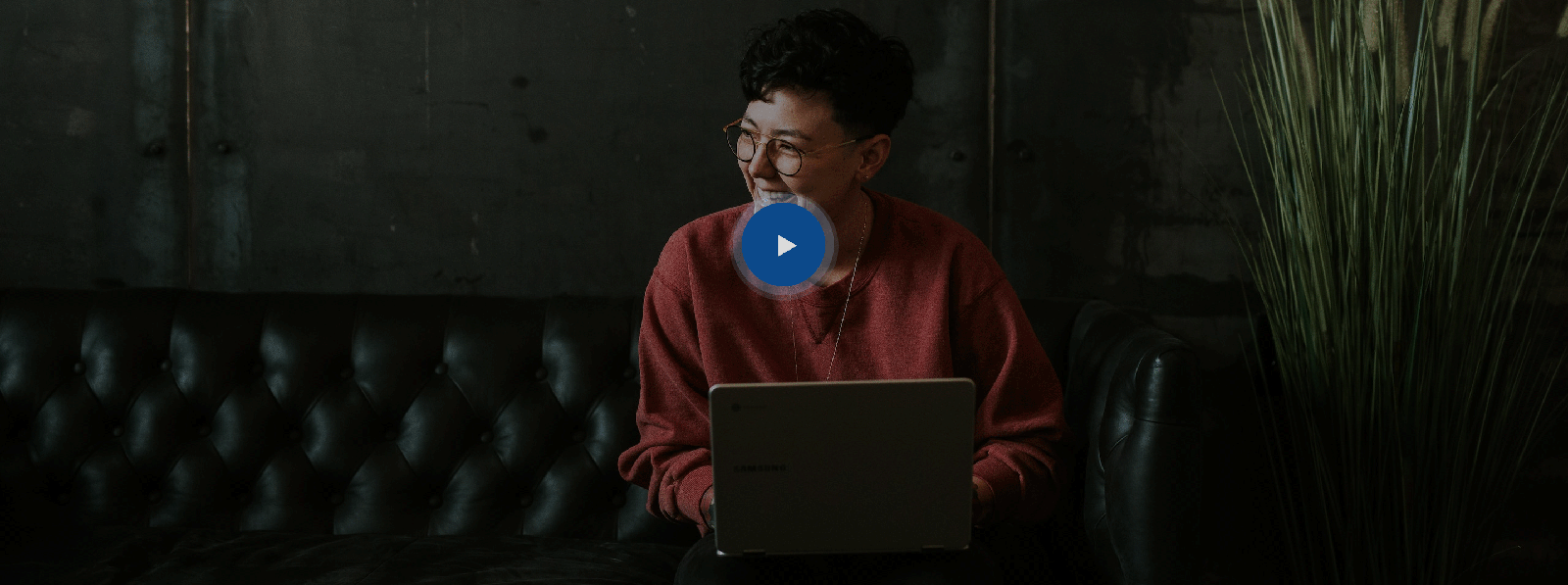

LISTEN TO SINA

MOHAJER ON THE

RADIO

-

Child Custody

-

Move Away Orders

-

Community Property vs. Separate Property

-

Who stays in the Family Home

-

Divorce Procedure

Best Divorce Asset Protection Lawyer in Arcadia

When it comes to securing your financial future, protecting your assets is key. But let’s be honest; life complicates things, especially when marriage leads to divorce. If you live in Arcadia, you should know that the state of California operates on a community property system. Any assets or debts accumulated during marriage are presumed to be split equally in a divorce. This may seem simple enough, but trust us; you could lose a significant portion of your hard-earned property without a solid asset protection plan in place. To avoid giving all that up, you should seek the legal guidance and support of a qualified asset protection lawyer in Arcadia.

What Does It Mean to Protect the Assets?

Asset protection refers to the strategies and tactics used to safeguard an individual’s financial assets, such as property, investments, and savings, from being claimed by creditors or seized in legal proceedings. Asset protection aims to minimize the risk of financial loss and ensure that your assets are protected in case of a lawsuit, bankruptcy, or other financial crisis. This can involve setting up legal structures, such as trusts and LLCs, as well as employing financial planning and risk management strategies.

Why Is It Important To Protect Your Assets?

- Peace of mind: By securing your assets, you can reduce financial risk and enjoy peace of mind knowing that your hard-earned wealth is protected.

- Minimize legal liability: By taking steps to protect your assets, you can minimize your exposure to legal liability and reduce the risk of losing your assets to creditors or lawsuits.

- Protecting wealth for future generations: An asset protection plan can help preserve your wealth for your children and grandchildren by minimizing the risk of loss due to creditors, lawsuits, or other threats.

- Financial security: A well-crafted asset protection plan can provide financial security and stability, reducing the risk of financial loss and protecting your standard of living.

- Maintaining control: By proactively protecting your assets, you can retain control over your financial future and ensure that your assets are distributed according to your wishes.

What Are the Steps to Protect Assets from Divorce in Arcadia?

Couples going through a divorce must decide how to split their property and assets or seek the assistance of the court to do it for them. Asset protection involves a complicated process. Arcadia asset protection lawyers at our firm break down the steps to protect assets from divorce in the following way:

- Learn about California community property laws: Understanding how assets and debts are divided in California during a divorce is the first step toward protecting your assets.

- Consult with a leading divorce asset protection lawyer in Arcadia: He or she can help you understand your rights and options and develop a strategy to protect your assets.

- Keep separate property separate: In California, property owned before the marriage is considered individual property and is not subject to division in a divorce. Protecting individual property is essential to protecting it from being shared in any property division agreement.

- Document all assets and debts: Keeping accurate records is crucial for a fair division of property.

Do I Need an Asset Protection Lawyer in Arcadia?

It depends on your specific situation and goals. Hiring an asset protection lawyer can be helpful if you want to ensure that your assets are adequately structured and protected and if you have complex financial circumstances or are facing a lawsuit or other legal threat. An experienced asset protection lawyer in Arcadia can advise you on the best strategies for protecting your assets and can assist with forming trusts, LLCs, and other legal entities to help you achieve your goals.

What Can My Arcadia Asset Protection Lawyer Do for Me?

- Advise you on the best strategies for protecting your assets, such as forming trusts or LLCs.

- Assist with forming legal entities, such as trusts or LLCs, that can help you protect your assets from creditors and legal proceedings.

- Review and revise your estate plan to ensure that it provides adequate protection for your assets.

- Represent you in legal proceedings, such as divorce or bankruptcy, which could impact your assets.

- Guide you on tax planning and compliance matters to minimize your financial exposure.

Reach Out to Mohajer Law Firm to Protect Your Valuable Assets

Reach out to Mohajer Law Firm in Arcadia for top-notch asset protection services. Our lawyers are highly skilled and experienced in protecting valuable assets during divorce and other legal proceedings. Trust Mohajer Law Firm to provide you with the very best legal representation. We are home to the best asset protection lawyers in the state. Contact us today at (626) 569-5200 or fill out our contact form and have your case evaluated by our team of experts.

We Represent Our Clients

in Every Legal Aspect of

California Family

Law

Mohajer Law Firm is committed to delivering unparalleled legal representation across the diverse landscape of California law, passionately advocating for our clients in every aspect of their legal journey.

Featured Client Stories

Juan Sanchez

CEO

Shawn Todd

CEO

Heather Dela Cruz

CEO

Badi M.

CEO

Related insights

Mohajer Law Firm is a full-service law firm that provides legal services to clients in various areas of law. The firm has a team of experienced attorneys dedicated to delivering quality service to their clients. They are knowledgeable in various areas of law and are committed to helping clients resolve their legal issues effectively and efficiently.

Frequently Asked Questions (FAQs)

Yes, creating a trust is a common way to protect assets in California. A trust can provide asset protection and tax benefits, among other advantages.

Yes, retirement accounts in California are protected from creditors under federal law and the state’s exemptions. IRAs and 401(k)s, for example, are protected under the Employee Retirement Income Security Act (ERISA).

Transferring ownership of your home to a family member may provide some asset protection in California, but it is important to consider potential gift tax implications and to follow proper transfer procedures to ensure the protection is valid.

Yes, incorporating a business in California can provide liability protection for the business’s assets and potentially your personal assets. However, it is important to follow proper corporate formalities and maintain a clear separation between personal and business finances to ensure the protection is valid.

CONTACT US

directly in any convenient

way.

Main Office

Suite A Arcadia, CA

91006

info@mohajer.com

Timimgs

Mon to Fri

9am – 6pm

Need professional Legal

Advice?

in touch with you soon